Sales and finance become one of the most important duos in a company when they are well integrated. Each one nourishes the other, showing the image of a solid and well-organized business. However, coordinating the multiple processes that occur in these areas and making them flow seamlessly between them can be a tremendous challenge.

So that your company does not experience such difficulties, Salesforce, the number 1 CRM in the world, has developed several solutions that are important to know about. We talked before about Salesforce CPQ, an interesting tool to optimize configuration and pricing, as well as quotes. Now it’s time to dive into another part of the process through Salesforce Billing.

What is Salesforce Billing?

Salesforce Billing, as its name suggests, is a CPQ add-on that specializes in billing. In a single data source, it integrates invoices, payments, and income, which allows companies to manage and bill their customers for unified products based on subscription and usage. With these means, it optimizes the provision of services and the payment experience. On the internal side, it improves both communication and collaboration between finance, sales, and other departments.

How does it work?

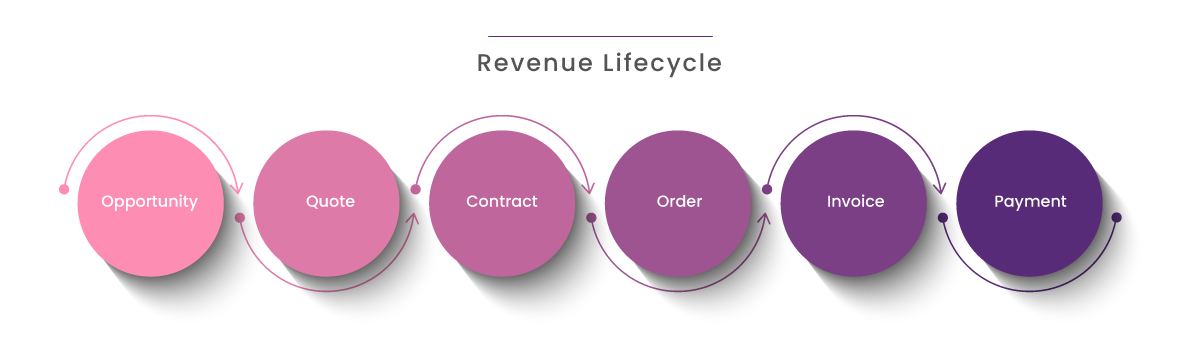

Although this billing process is sometimes seen only through invoice and payment papers, the income life cycle really begins from the first contact with Sales.

Although the first three stages Opportunities, Quotes, and Contracts are the responsibility of the sales department, they actively affect the billing process. Once the Sales process finishes, it will generate contracts and orders that allow invoicing to begin. This is where Salesforce Billing steps in, managing the order, billing, and collection stages. This solution will allow you to streamline the cash collection process. How? Well, take a look at its main features.

Key features of Salesforce Billing

- Payments and allocation of payments to invoices: allows tracking of payment methods and routes, offering flexibility to the customer in the process. In addition, it can be integrated with the main payment processors and thus schedule payment executions and automating invoice balances. As if that weren’t enough, the advanced accounts receivable features allow for flexible allocations at the line-item level, bringing more precision to the collections process.

- Invoice Refunds and Adjustments: provides flexibility to manage adjustments to a customer’s balance or accounts receivable, whether it’s adding fees or credits to invoices, correcting errors, or canceling services.

- Accounts Receivable: provides a detailed view of accounts receivable. In addition, it offers reporting functions and is easily customizable to the needs of each company.

- Notifications of claims and collections: it speeds up and automates the claims process before the collection of invoice balances that have expired.

Benefits

Without a doubt, the fundamental benefit of Salesforce Billing is its ability to optimize one of the company’s pillars: finances. However, digging deeper, we can cite more specific advantages.

- Provides reliable, accurate, and automated billing without human error.

- Reduce the collection cycle, improving the cash flow of your company.

- Allows you to establish, through subscriptions, recurring relationships by managing all types of income, changes, and any additional services provided.

- Allows quick and flexible billing adjustments for the customer.

- Shows on a single screen, an interactive, simple, and intuitive interface.

Why integrate CPQ and Salesforce Billing?

The real question would be why not. As we discussed before, the revenue life cycle begins with sales. Salesforce CPQ makes it easy for sales reps to set up, price, and prorate line items on a quote. Additionally, it also helps sell the right product bundles, control discounts, and automate approvals which generate a contract and an estimate. When the order is placed, Salesforce Billing inherits the key records and information from the CPQ, allowing it to create the invoice and related transaction records.

In other words, because the sales and finance processes are interdependent, CPQ and Salesforce Billing were created to work together, complimenting each other. The advantages of this integration are:

- Streamlines the billing process if, through Salesforce CPQ, the price is properly quoted, the contract is respected and the order amounts are properly prorated. Additionally, if the proper credits and discounts are applied, billing goes smoothly and quickly.

- Many of the errors from recalculation and duplication of information disappear. Allows the creation of a single source of information and thus data flows seamlessly through the stages of the revenue lifecycle.

- Improve sales performance, as Salesforce Billing is designed to take advantage of the CRM AI engine. This allows proper forecasting of revenue, annual contract value, cash flow, and other key performance indicators.

- Boosts customer relationships by automatically linking their billing records to their Salesforce profiles. This reinforces the comprehensive 360-degree vision of each client, providing the necessary information at all times. In addition, it provides a smooth and positive experience throughout the sales and payment process.

- Both Salesforce CPQ and Billing solutions complement the Enterprise Resource Planning (ERP) Platforms, since, together, they collect and convert order data from potential customers into transactional data at the service of the entire company.

If you already use CPQ, it would be most likely and wise to start using Salesforce Billing, a powerful tool aimed at optimizing revenue. If you don’t use any, what are you waiting for to strengthen relationships between your sales and finance departments, as well as continue to build relationships with your customers? Do not forget that finances also represent a point of contact with the client. At SkyPlanner we can help implement these tools. Feel free to write to us at hello@theskyplanner.com.